Deadlines extended for filing I-T returns, GST; IBC rules relaxed

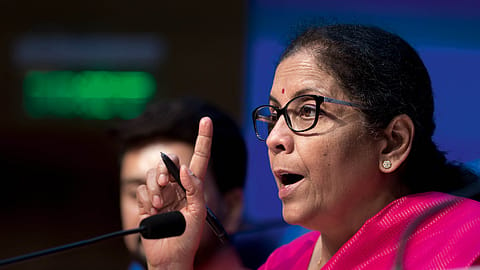

Finance minister Nirmala Sitharaman relaxes regulatory and compliance norms for individuals and companies as the economy navigates a tough time caused by the Coronavirus outbreak.

Finance minister Nirmala Sitharaman announced an extension of deadlines for filing income tax returns, goods and services tax, and customs and central excise taxes as the economy navigates a tough time caused by the Coronavirus outbreak and the consequent lockdown.

Sitharaman assured that a stimulus package to address the current economic crisis was in the works and would be announced “sooner than later”. “An economic package is being worked upon and the Prime Minister is closely monitoring the situation,” said the minister. She added that a multi-layered task force comprising industry leaders, academics, Members of Parliament had been set up which was providing valuable inputs. These inputs, she assured, would be taken into account while framing the stimulus package.

Among the more important statutory and regulatory relief measures included raising the threshold level of companies falling into the ambit of the Insolvency and Bankruptcy Code (IBC). The threshold of default has been hiked from Rs 1 lakh to Rs 1 crore to prevent insolvency proceedings against the small and medium enterprises (SME) sector. “We will watch the situation and if it improves, there is no worry. But if it continues to be like now, beyond April 30, 2020, then we may consider suspending Section 7, Section 9 and Section 10 of the IBC for a period of six months,” Sitharaman added.

With falling demand and rising inventories, these measures will help the sector because SMEs are most vulnerable to the ups and downs of the economy.

Deadlines to file March, April and May I-T returns have been extended till June-end. The minister also announced that companies with less than Rs 5 crore turnover, will not have to pay interest, late fee or penalty; however, for bigger ones, no late fee and penalty will be charged, but the interest will be levied at a reduced rate of 9%.

The penalty for delayed TDS deposits has been slashed from 18% to 9%. Rules have been modified for newly incorporated companies and also company directors. Even if a company director has not stayed in India for the mandatory 183 days, it will not be treated as a violation under Section 149.

Those availing the recently-launched Vivad Se Vishwas Scheme (to resolve their indirect tax dispute) have been provided time till June 30; the additional 10% payment to resolve disputes has been waived. Daksha Baxi, partner, Cyril Amarchand Mangaldas, says the extension is a “welcome and opportune step”. “This will make it possible for taxpayers to assess their litigation position better and take advantage of the scheme where appropriate. It would have helped if the dates for TDS payment and compliance were also postponed,” she said.

Recommended Stories

Similarly, the deadline to link Aadhaar with PAN too has been extended till June 30, and Sitharaman has promised to keep customs clearance open 24x7 up to June 30 to help exporters and importers, who too are facing difficult times.

As the spread of Covid-19 intensifies, individuals have been allowed to withdraw money from any bank’s ATMs without extra charge. Maintaining a minimum amount balance is also no longer mandatory.

Arun Singh, chief economist, Dun and Bradstreet India, said the measures announced by the finance minister are a huge help for businesses. “While these are just regulatory and compliance related announcements, these will facilitate the ease of doing business and reduce cost of compliance for business,” he said.