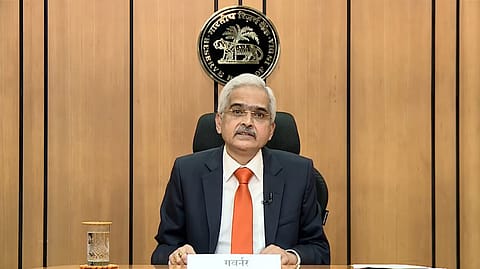

Emerging economies resilient despite global banking turmoil: RBI Guv

Das says EMEs did not face “adverse spillover effects” from recent banking sector turmoil in advanced economies due to wider adoption of Basel III norms and improvements in supervisory practices

Reserve Bank of India (RBI) Governor Shaktikanta Das, addressing the 59th SEACEN Governors' Conference in Mumbai today, said the global economy stands at a crossroads, and that in an uncertain world, central banks need to be proactive to serve the objectives of price and financial stability.

The South East Asian Central Banks (SEACEN), as a platform for the region's central banks, serves as a "valuable forum" for sharing insights and fostering cooperation in several areas, he says, adding the countries should give "due consideration" to the principles of comparative advantage and resource endowments.

Speaking about the resilience of the global economy, Das citing the IMF data says the global growth is projected at 3.1% in 2024 and 3.2% in 2025, with the forecast for 2024 revised upward by 0.2 percentage points from its October 2023 projection.

"The resilience of emerging market economies (EMEs), in particular, stands out unlike previous episodes of volatility which saw EMEs at the receiving end," says Das.

Das says the EMEs did not face adverse spillover effects from the recent banking sector turmoil in the advanced economies (AEs) in March 2023, due to the strengthening of prudential regulation through wider adoption of Basel III norms and improvements in supervisory practices.

Also, Das says their improved “macroeconomic fundamentals” and buffers have provided a cushion against global shocks of the last four years.

The fiscal and monetary stimulus provided during COVID-19 has not been fully rolled back, especially in advanced economies, he says, adding that it restricted the degree of spillovers from policy tightening by the AEs. A "greater diffusion of technology in industry and services has gained traction" after the pandemic, enhancing productivity in several emerging market economies and offset the adverse impact on output from factors like monetary tightening, he says.

Notably, the IMF has raised India's GDP growth projections by 20 basis points to 6.5% for FY25, owing to resilience in domestic demand. It expects the country's GDP to grow by 6.7% in FY24 against 6.3% estimated earlier.

However, the IMF’s global forecast for 2024–25 is below the historical (2000–19) average of 3.8%, with elevated central bank policy rates to fight inflation, a withdrawal of fiscal support amid high debt weighing on economic activity, and low underlying productivity growth. “ Global headline inflation is expected to fall to 5.8 percent in 2024 and to 4.4 percent in 2025, with the 2025 forecast revised down,” says IMF.

On the changing landscape of the global economy, Das says the pandemic has indeed highlighted the need for more granular and sectoral analysis. First, the world after the pandemic has changed fundamentally in terms of shifting labour market dynamics, work processes and technological deepening, he says. Technologies like AI & ML open new opportunities, but they also present challenges, he says.

Secondly, he says, the high indebtedness of countries may constrain monetary policy due to a sharp trade-off between price stability and financial stability. Additionally, Das says, globalisation has caused “growing trade fragmentation”, technological decoupling, disrupted capital flows and labour movements.

(INR CR)