Has Covid-19 changed shopping forever?

According to a report released by e-commerce platform Shopify, Covid-19 has ended up creating a new normal, and this new normal is not only about the way we live, but also about the way we shop.

The Coronavirus pandemic has fundamentally changed the way we shop. According to a recent report released by the Canadian e-commerce platform Shopify, Covid-19 has ended up creating a new normal, and this new normal is not only about the way we live, or how we interact with people, but also about the way we approach shopping.

Titled Future of Commerce 2021, this Shopify report—written by marrying global merchant data coupled with several consumer surveys—tries to use the pandemic as a crystal ball to gaze into the near future. And the changes it sees are radical.

The report argues that while the pandemic pushed e-commerce to top gear, enabling a behavioural shift away from physical retail stores, this change is primarily being driven by young and middle-aged consumers. Strikingly, ever since the pandemic started, 84% of consumers have shopped online, while a paltry 38% have shopped in-store. As per the consumer survey data used by Shopify, 85% of consumers said that they will shop regularly online, for at least the next six months, compared with 31% of respondents who said they would prefer to visit a store for the same.

Social media, the report notes, has also played a crucial role in changing consumer behaviour. In fact, the report argues that for brands to stay relevant and to ensure visibility, social media has become the pathway to do so. 55% of younger consumers who purchase from independent retailers discover brands through social media. Amongst middle-aged consumers, 45% use social media to know and discover brands and the number goes down as the age gap increases.

“Although we have seen the greatest shift online among young consumers, the other key segments including middle-aged and older consumers are also seeing significant numbers starting to go online for their shopping needs,” says Sandeep Komaravelly, Director of International Growth at Shopify. Komaravelly also points out that these trends brought to the fore by the pandemic, are likely to persist even after the pandemic has subsided.

Creating value

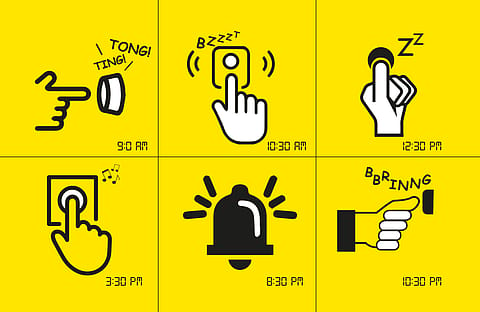

With such changes being wrought at the behavioural level, retail stores had to follow suit. The report anticipates that physical retail stores would permanently evolve, with omnichannel features and experiences being the permanent mainstay. The pandemic had posed an existential threat to these physical retailers and in order to survive they were compelled to adapt to newer business strategies. These strategies included contactless payments, an ever-greater reliance on e-wallets, and an alternative delivery and pickup methods. Amongst the latter, the usage of pickup points and contactless delivery saw an uptick during the pandemic. The Shopify report argues that these business strategies employed by physical retailers are going to stay.

Recommended Stories

Talking to Fortune India on the changes Covid-19 has brought in shopping behaviour along with subsequent changes seen amongst retailers, Ankur Bisen, senior vice president of the retail and consumer products division at Technopak, a management consultancy firm, argues that for physical retailers the choice was simple: either adapt or sink. Hence, there was an increasing need to use and exploit the digital pathway in order to get to their customer. “A host of physical retailers saw that they had to use digital in some way or the other in order to sell their goods. So even for small retailers, they had to onboard or partner with an e-commerce outlet.”

Harminder Sahni, founder and managing director of Gurugram-based Wazir Advisors, a business consulting company, however, differs slightly on this. He argues that many of the changes in consumer behaviour are not permanent and when the pandemic subsides, many things will return to the way they were before. And key in this is the notion that physical retail is finished. “Look, even e-commerce sites have realised that they cannot exist solely as online platforms, and physical retailers have realised that they cannot exist only offline. There is a convergence, and you have the rise of an omnichannel pathway, where there is a combination of the two existing side by side,” he says.

But Bisen sees far-reaching changes on some aspects of consumer behaviour, which in turn, are reflected in the business strategies of retailers. For Bisen, the pandemic giving a fillip to e-commerce is a kind of truism and the same needs to be understood in a more nuanced way.

“See, the pandemic created a sharp schism between aspirational shopping and need-based shopping. As the country went into a lockdown, plus with economic woes, it is the latter that has taken precedence,” he says.

(INR CR)

This shift towards need-based shopping—which would include buying those items which are considered essential, rather than those which are discretionary—has in turn given impetus to value sensitivity in the minds of the customer. “Across commodities, people are looking for alternatives which can give the same value without too much expense. Things premium now require a justification, whether it be premium cars, or premium foods, or premium technology. There is a clear demand in electronics, for example, now to buy second-hand items, and this is pushing up the retrofitting market,” Bisen says.

In light of this, Bisen argues, e-commerce platforms which exclusively deal with retrofitting, like Olx for instance, are doing brisk business. Similarly, a trend is being seen in apparels where things are not the same as they were nine months ago. “In apparels, we need to understand that people are working from home. So a sharp fall is being seen in office or formal wear. But this, in turn, has shot up the demand for leisure wear and athleisure,” Bisen says. In other words, values placed on brands have a certain context, and in an uncertain and fluid market, this context needs to be grasped.

Sahni, similarly, argues that brand value in itself isn’t a monolith. “Think of it this way. I want a cheap, inexpensive shirt. Now I won’t go and buy one which is selling dirt cheap. Because in my mind the price of a commodity is also related to the quality of the commodity and its social value. But, at the same time, I want an inexpensive shirt. Because the consumer is brand conscious, he or she relies on a few set brands which they feel provide them with best quality,” Sahni says. Now, Sahni argues, this is where e-commerce companies come in. For Sahni, the consumer will look at a particular brand he or she prefers, choose which e-commerce site is giving the best deal and go with it.

Sahni’s pronouncements are borne out by an October report from the global business consultancy firm, McKinsey & Company. As per the McKinsey report, globally, and particularly in India, brand loyalty has taken a major hit during the pandemic. The report argues that whether it is brands consumers shop at retail stores, or retail brands themselves, both can no longer claim to have a hold over the consumer’s psyche. The report says that a staggering 96% of people surveyed in India say that they have changed their ways of shopping, brands they shop for, and the stores they shop from.

“In this quest for best value, which this pandemic has brought in focus, the question of brand loyalty doesn’t arise anymore. It is being replaced by brand consciousness. Customers will go for the brand with best value,” Sahni says.