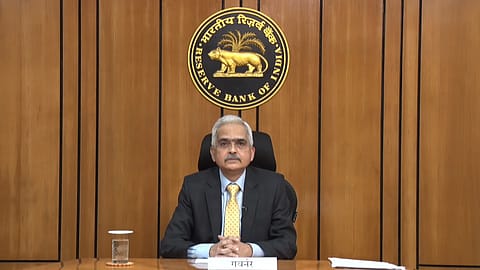

High inflation 'major concern', changing its course priority: RBI

Reserve Bank governor Shaktikanta Das says policy measures could impact demand in the short-term but moderating inflation pressure is crucial at this stage.

Reserve Bank of India (RBI) governor Shaktikanta Das has said high inflation remains a major concern, and that the revival of economic activity is steady but is gaining traction. Amid this, moderating inflationary pressures is crucial, he says, to ensure a stable macroeconomic environment, the June 9 Monetary Policy Committee (MPC) minutes of the meeting reveal.

"Changing the course of inflation trajectory to reach targeted level is a priority at this stage for monetary policy although the growth momentum remains modest," he adds.

RBI hiked the key repo rate by 50 basis points to 4.9% this month. Before that, in an off-cycle meeting in May, it hiked the repo rate by 40 bps to 4.40%. Das says inflation increased significantly since the RBI's April and May MPC meets this year. Retail inflation rose to 7% in March and 7.8% in April on a YoY basis. In May, the retail inflation eased to 7%, which was lower than many advanced economies, but above the RBI's upper tolerance level.

The inflationary pressure is linked to rising costs of the three major components — food, fuel and miscellaneous. Notably, the inflation rate has been rising since October 2021, though its trajectory is significantly steeper since March 2022.

Das says rising costs — even as supply began to regain some normalcy after Covid-19 waves — hit the economy due to the increasing commodity prices in global markets. The commodity prices, in turn, have been on the rise since March due to disruptions caused by the Russia-Ukraine war that started in February.

"In the case of food inflation, the supply interruptions in the international markets on account of both production shortfalls and war-induced supply restrictions of edible oils and wheat have exacerbated the emerging supply-demand imbalance," says Das, adding that fertiliser and other input supplies also hit the agricultural sector. Energy prices, in general, have been hit by supply disruptions and continued demand.

During its last MPC meeting, the RBI revised the retail inflation rate projection for FY23 upwards to 6.7% from 5.7% estimated in its April meeting, mainly on account of an increase in average crude oil price and food inflation for the year, affecting the trade balance.

Recommended Stories

Das thinks normal rainfall could moderate the major commodities' prices, although global supply conditions for food commodities would play a huge role in deciding the food inflation course. These pressures, as per the RBI governor, that have intensified since March may remain a concern throughout the year unless the global supply conditions improve quickly.

The need is to ensure policy rates are consistent with the requirements of moderating inflation expectations and liquidity conditions are consistent with the requirements of economic growth, in an environment less constrained by the Covid pandemic, says Das.

He also believes that these policy measures could have some impact on demand in the short term but moderating inflation pressure is crucial at this stage.

The RBI in this month's monetary policy announcement projected that inflation in Q1, Q2, Q3 and Q4 of FY 2022-23 is expected to be 7.5%, 7.4%, 6.2% and 5.8%, respectively.

(INR CR)

On GDP, Das says though domestic monetary and economic policies remained supportive of growth through the pandemic period, achieving sustained growth has been a challenging goal. Globally, the uncertainty over the pandemic continues as many nations are still reporting infections. The provisional GDP estimates by the National Statistical Office (NSO) place the FY22 GDP growth at 8.7%, reflecting the catch-up of private final consumption expenditure, gross fixed capital formation and overall GDP, all measured in constant prices, with the pre-pandemic year 2019-20.

Considering the present trends, the RBI thinks GDP will grow at 7.2% in FY23; this projection is the same as estimated in the April MPC meeting.