Huge opportunity in India for Detroit-like city for EVs: CEA

The CEA, Krishnamurthy Subramanian, feels that the major impediment to increased adoption of EVs in India seems to be the limited availability of charging infrastructure.

There is a huge opportunity for Indian cities to become Detroit-like manufacturing hubs for electric vehicles, according to the Economic Survey 2018-19. “It may not be unrealistic to visualise one of the Indian cities emerging as the Detroit of EVs in the future,” it says.

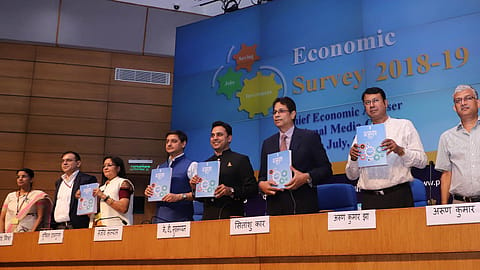

The survey, prepared by Chief Economic Adviser (CEA) Krishnamurthy Subramanian, was tabled by finance minister Nirmala Sitharaman in Parliament on Thursday. Sitharaman will present her first Union Budget on Friday.

Quoting the NITI Aayog, the survey says if EV sales penetration in India reaches 30% for private cars, 70% for commercial cars, 40% for buses, and 80% for two- and three-wheelers by 2030, “a saving of 846 million tons of net CO2 emissions and oil savings of 474 MTOE (Million Tonnes of Oil Equivalent) can be achieved”.

“It also provides us an opportunity to grow as a manufacturing hub for EVs, provided policies are supportive. While various incentives have been provided by the government and new policies are being implemented, it is important that these policies not only focus on reducing the upfront costs of owning an EV but also reduce the overall lifetime costs of ownership,” Krishnamurthy Subramanian says in his maiden economic survey.

Subramanian feels that the major impediment to increased adoption of EVs in India seems to be the limited availability of charging infrastructure.

“We find that the market share of EVs is positively related to the availability of chargers and a larger availability of chargers corresponds to a greater adoption of EVs. The market share of EVs increases with increasing availability of charging infrastructure,” the CEA says.

“This is primarily due to the limited driving range of batteries in the EVs. It, therefore, becomes important that adequate charging stations are made available throughout the road networks.”

Many countries are encouraging the uptake of EVs through incentives. For example, Norway, which has the highest share of electric cars, has provided generous incentives such as exemption from value-added tax, tax incentives on import and purchase of EVs, and waiver of toll, ferry and parking fees. Market share of EVs has gone up in China thanks to subsidies and steady investment in charging and battery infrastructure.

“Given the various incentives given in the different countries, it is only natural to ask whether these incentives have had any impact on the uptake of electric vehicles. While a number of studies seem to indicate that incentives have been effective, some studies have indicated their ineffectiveness and have shown that charging infrastructure is a more important determinant of EV uptake,” Subramanian says.

Subramanian also says that appropriate policy measures are needed to lower the overall lifetime ownership costs of EVs and make them an attractive alternative to conventional vehicles for all consumers. While the government has given an impetus to the promotion of quality public transport, especially through the introduction of metro projects in various major cities, a shift to electric mobility in road transport can lead to beneficial results, he says.

The survey says with the world’s second largest population and an area of 3.3 million square kilometres, it is not difficult to understand how important the transport sector is for the Indian economy. In India, transport sector is the second largest contributor to CO2 emissions after the industrial sector. The survey quotes a 2018 report by the Ministry of Environment, Forest and Climate Change to say that road transport accounts for around 90% of the total emissions in the transport sector in India. The survey says that increasing vehicle ownership has also meant that demand for fossil fuels for these vehicles has increased.

(INR CR)

“Given the large import dependence of the country for petroleum products, it is imperative that there be a shift of focus to alternative fuels to support our mobility in a sustainable manner,” Subramanian wrote.

The CEA adds that “National Electric Mobility Mission Plan 2020 (NEMMP)” was conceived with the objective of achieving sales of 60-70 lakh EVs by 2020. In 2015, the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) scheme was launched to fast-track the goals of NEMMP with an outlay of ₹795 crore. In 2019, phase II of FAME India was launched with a total outlay of ₹10,000 crore. Phase II, which took effect from April 1, will run for three years. “Emphasis in this phase is on electrification of public transportation,” the survey states.

Subramanian then goes on to talk about the global scenario of electric vehicles. According to the economic survey, global sales of electric cars have been rising at a fast pace from just over 2,000 units being sold in 2008 to over 10 lakh in 2017. More than half of these sales were in China. Electrification of two-wheelers and buses has also picked up pace in recent years, it says.

In 2017, global sales of electric buses were about 1 lakh and sales of two-wheelers are estimated at 3 crore, the survey says.

“In India, electric two-wheelers have been the major part of EV sales with sales of around 54,800 in 2018 (NITI Aayog, 2019). Compared to this, sales of electric cars have been only around 2000 in 2017 (IEA2, 2018). Indian market share of electric cars is a meager 0.06%,” the CEA says.

In state-wise EV sales, Uttar Pradesh topped the list with around 6,878 units in 2017-18, followed by Haryana at 6,307 units, and Gujarat at 6,010 units, according to the Society of Manufacturers of Electric Vehicles (SMEV).

“The country’s economy is growing and would continue to grow at a rapid pace in the coming years. This presents a great opportunity for the automobile industry as demand for automobiles would only increase. Given the commitments that India has made on the climate front as a nation and the increasing awareness of the consumers on environmental aspects, it is likely that larger and larger share of automobile sector would be in the form of electric vehicles,” Subramanian says.