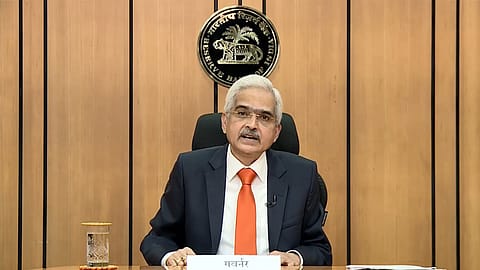

‘Outstanding job’: RBI’s Shaktikanta Das named ‘Governor of Year’

Das has cemented critical reforms, overseen world-leading payments innovation and steered India through difficult times, says Central Banking publication

Shaktikanta Das, Governor of the Reserve Bank of India (RBI), has been named the 'Governor of the Year' for the year 2023 by Central Banking, an international economic research journal.

"The RBI governor has cemented critical reforms, overseen world-leading payments innovation and steered India through difficult times with a steady hand and well-crafted turn of phrase," the publication says in its latest piece 'Governor of the year: Shaktikanta Das'.

Shaktikanta Das, an IAS officer, and former secretary at the departments of revenue and economic affairs, ministry of finance, assumed charge as the 25th governor of the RBI on December 12, 2018. His tenure was extended by three more years in 2021 amid the Covid crisis, making him the fifth RBI governor to get tenure this long so far.

Covid-19 was "no doubt the biggest crisis" Das faced as the RBI chief, but his tenure, which began in December 2018, has been "marked by a series of grave challenges” like the collapse of a major non-bank firm, coronavirus pandemic, and Russia’s invasion of Ukraine and its inflationary impact, says the publication.

Shaktikanta Das is the second RBI governor after Raghuram Rajan to have won the 'Governor of the year' award. "All RBI governors face the difficulty of working with governments that have different priorities to the central bank, and most will have to overcome crises during their tenures. But few have had to contend with challenges on the scale that Das has met."

The piece acknowledges that when Das took office in 2018, it looked like the "financial sector could blow up at any minute", putting decades of progress at risk. Citing an example of IL&FS, a major non-bank financial company (NBFC), that entered bankruptcy in 2018, the write-up says the firm became the first NBFC to be resolved under a revised bankruptcy code, which the former governors fought hard to deliver.

"Other aspects took place solely under Das’s tenure, including the roll-out of liquidity rules for non-banks and closer supervision of key players in the sector."

Recommended Stories

It says the short-selling attack on Adani in late January also triggered fears over major banks’ exposures, including that of State Bank of India, India’s largest public sector lender that has exposures of $3.3 billion (around 0.9% of the loan book) to the Adani empire.

The publication attributed Das for making an immense contribution to the advancement of the 'payments revolution' in the country. "The RBI’s Unified Payments Interface (UPI) has made instant electronic payments available to hundreds of millions of people and is seen widely as one of the most advanced payments platforms in the world."

Besides, QR codes can now be used to make offline payments and the RBI has proposed using them to allow cardless cash withdrawals. The RBI also linked UPI with Singapore’s PayNow on February 21, and more cross-border connections are planned, it added.

India is also near the front of the pack on central bank digital currency (CBDC), which the RBI is trialling in pilots for retail and wholesale systems. "The rollout of an e-rupee to more than a billion people would be a project whose scale is matched only by China’s e-yuan," says the piece.

(INR CR)

An economy as complex as India’s will likely never be free from challenges but, the article reads that, "as Das faces up to the remainder of his second term, he can take pride in major achievements so far".