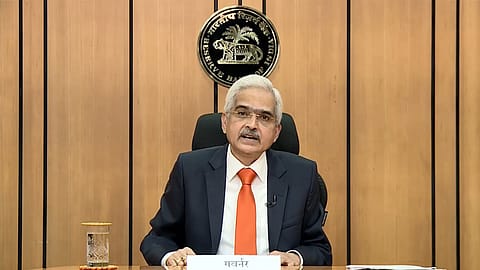

Over two-thirds of ₹2,000 notes back in a month of withdrawal: Shaktikanta Das

RBI Governor says of total value of ₹3.62 lakh cr, ₹2,000 banknotes worth ₹2.62 lakh crore have already been exchanged or deposited in banks

Reserve Bank of India (RBI) Governor Shaktikanta Das has said around two third of ₹2,000 banknotes have been deposited or exchanged in banks since the central bank announced to withdraw the currency notes on May 19, 2023.

The RBI chief said of the total value of ₹3.62 lakh crore, the ₹2,000 banknotes worth ₹2.62 lakh crore have already been exchanged or deposited in banks.

Das, in the latest interview with PTI, said there will not be any monetary instability because of the withdrawal of ₹2,000 currency notes. "One thing I can clearly tell you that the ₹2,000 note that we are withdrawing right now will not have any negative impact on the economy”.

He said nearly 85% of the total currency that has come back in the system is in deposits.

Earlier this month, too, the RBI Governor had said that on a provisional basis, about 85% of ₹2,000 notes are coming back as deposits into bank accounts, which is in line with the RBI’s expectations.

There were only 18,111 lakh pieces of ₹2,000 notes, constituting around 1.3% of the total volumes of currency in circulation as of March-end. The value of ₹2,000 banknotes in circulation stood at ₹3.62 lakh crore – about 10.8% of the total currency in circulation.

The RBI Governor also talked about the central bank's inflation target, saying it'll try to bring down inflation to the level of 4%. According to Das, consistent rate hikes, along with the government's push on the supply side, helped contain inflation to below 4.25% in May 2023 from 7.8% in April 2022.

(INR CR)

The country’s retail inflation had hit a 25-month low of 4.25% in May compared with 4.7% in April. This is the third month that the CPI-based inflation remained within the RBI target limit of 4% to 6%. Retail inflation in March stood at 5.66%, whereas it stood at 6.44% in February.

On the country's GDP, Das said the RBI's estimates of a 6.5% expansion in real GDP have come after careful consideration of all economic indicators. The RBI's monetary policy committee (MPC) this month projected the real GDP growth for 2023-24 at 6.5%, with Q1 at 8%, Q2 at 6.5%, Q3 at 6%, and Q4 at 5.7%.

Notably, global agencies have projected lower growth for India in the first quarter of 2023-24. The World Bank has retained its April forecast for India's GDP growth at 6.3% for 2023-24, which, however, is a 0.3 percentage point downward revision from January.

Similarly, the International Monetary Fund (IMF), in its latest 'Regional Economic Outlook', said emerging markets and developing economies, including India and China, are expected to account for about 80% of global growth this year and next, with India alone expected to contribute over 15%.