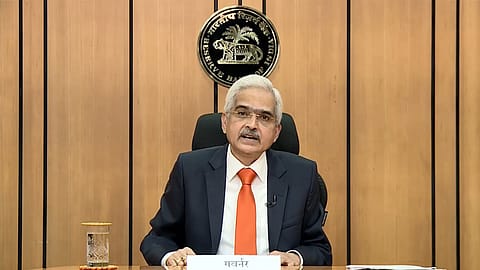

RBI governor defends rupee; says zero tolerance for bumpy movements

RBI says the rupee is holding up “well” relative to both advanced and EME peers, and the movement of the rupee has been smooth despite global spillovers

The Reserve Bank of India (RBI) governor Shaktikanta Das says the movements of the rupee have been relatively smooth and orderly due to its “actions” despite global spillovers overwhelming most countries, including the advanced ones.

The impact of spillovers from the global monetary policy tightening, the geopolitical situation, the still elevated commodity prices – especially crude – and the lingering effects of the Covid in India, has been relatively "modest", says Das.

These spillovers have become overwhelming for all countries. "Even reserve currencies such as the Japanese yen, the Euro and the British pound sterling have not been spared," says Das at the Bank of Baroda’s annual banking conference in Mumbai today.

As per the RBI governor, the Indian rupee is holding up well relative to both advanced and EME (emerging market economies) peers. "This is because our underlying fundamentals are strong, resilient and intact."

The Indian rupee hit a new lifetime low of 80.05 per US dollar on July 19 amid unabated foreign fund outflows and high crude oil prices. However, the currency appreciated a bit since then to 79.92 per dollar.

Foreign brokerage Nomura expects the Indian rupee to fall to 82 against the dollar by the third quarter of 2022 amid a widening trade deficit. Nomura projects the local currency to rise to 81 in the fourth quarter.

“I would like to reiterate that we have no particular level of the rupee in mind, but we would like to ensure its orderly evolution and we have zero tolerance for volatile and bumpy movements,” says Das.

Recommended Stories

On India's macro-economic situation, the governor says the recovery is gradually strengthening. "The current account deficit is modest. Inflation is stabilising. The financial sector is well-capitalised and sound. The external debt to GDP ratio is declining. The foreign exchange reserves are adequate."

The RBI governor's views echo the finance ministry's recent report that said the "rupee has performed well in 2022 compared to other major economies" due to "strong fundamentals".

The ministry report, however, said the widening of CAD (current account deficit) has depreciated the Indian rupee against the U.S. dollar by 6% since January of 2022. India's forex reserves have declined by $34 billion in the six months since January 2022 in a bid to finance the widening CAD and rising FPI inflows.

The RBI governor says the central bank is supplying U.S. dollars to the market to ensure there is adequate forex liquidity and to make up for a genuine shortfall of supply of forex in the market relative to demand.

(INR CR)

Also, a predominant part of the outstanding ECBs is effectively hedged, he says. "Of the outstanding ECBs of $180 billion, 44% or $79 billion is unhedged," says Das, adding that for India, its internal research estimates the optimal hedging ratio at 63%.

The central bank this month relaxed norms for companies raising external commercial borrowings (ECBs) in order to stop continuous depreciation in the domestic currency. The RBI notified that in the case of ECBs, till up to December 31, 2022, the borrowing limit under the automatic route will be increased to $1.5 billion from $750 million currently.