RBI lost case, but can win battle against crypto

One of the main reasons of RBI losing to crypto lobby in the Supreme Court was lack of proofs against crypto-exchanges that latest ED investigations can provide now

The Directorate of Enforcement (ED) is currently handling multiple cases with respect to the crypto businesses that involve money laundering and fraud. Fraudulent initial coin offers, phishing, NFT wash-trading, etc., are rife in the crypto-ecosystem and Indians have been falling prey to both foreign and domestic fraudsters, quite frequently.

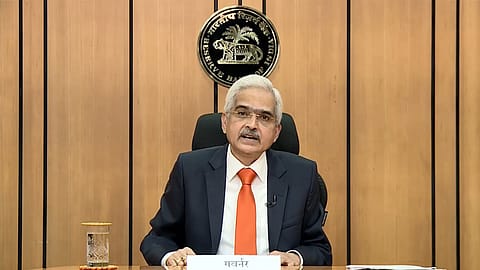

The Reserve Bank of India (RBI) had historically opposed the crypto ecosystem and tried to contain its growing threat. In 2020, the RBI failed in its efforts after losing out to the crypto firms in the Supreme Court.

Had the Reserve Bank of India (RBI) won the case, the common people of India may have been spared much heartburn from crypto dealings, and the country would not have incurred huge financial losses from money laundering.

Ironically, the grounds on which the Supreme Court ruled against the RBI may no longer be valid in the wake of multiple crypto-scams and cases of money laundering that are under investigation. If the RBI is dragged to the court again due to similar actions, there are high chances that the apex court may rule in its favour. In fact, this time, crypto-exchanges like WazirX that are, allegedly, partly or wholly owned by foreign entities, may not have the privilege to avail legal recourse, similar to the previous case.

IAMAI Vs RBI Case of 2018

Since 2013, the RBI had been issuing public circulars as warning against digital assets. The growth on public interest in crypto ecosystem and, lack of any regulatory measures initiated by the government, perhaps, prompted the RBI to issue a circular to its subordinate entities, like banks in April 2018, that stated -- the regulated entities are directed not to provide services for facilitating any person or entity in dealing with or settling virtual currencies, aka, cryptocurrencies. This circular, issued on 6th April 2018, had effectively brought the business of crypto-exchanges to a grinding halt in India.

The crypto-exchanges banded together with the Internet And Mobile Association of India (IAMAI) and the latter filed a writ petition against the RBI’s notice in the Supreme Court. A three bench Judgment of the apex court set aside the impugned circular on March 4, 2020, following which the common people of India could transfer fiat money from their bank accounts to invest or trade in cryptocurrencies, NFTs, etc.

Basis of Supreme Court’s Judgment

While the Apex Court agreed the Reserve Bank of India was well within its powers to stop the entities regulated by the RBI from dealing with any person, businesses or individuals, dealing with cryptocurrencies, the court had set aside the RBI’s circular on the ground of proportionality, as per Para 7.1 of the Judgment.

The crypto-lobby had argued that the RBI’s circular had infringed upon the crypto-exchanges’ right to profession, which is a fundamental right under Art. 19(g) of the Constitution. This, in essence, meant that the impact of the circular on the crypto-exchanges, which were rendered comatose due to the stoppage of their dealings with the banks, was a disproportionate reaction to the apprehensions of the RBI about the crypto businesses.

What Changes Now?

(INR CR)

When IAMAI invoked Art. 19 (g) to question the proportionality of the RBI’s circular, one of the crypto-exchanges, WazirX, was an Indian entity. As per latest claims on Twitter by its founder, Nischal Shetty, WazirX now belongs to Binance, which is a company of Chinese origin, now based in Cayman Islands. In such a scenario, WazirX, or any foreign entity owning the whole or a substantial part of an Indian crypto-exchange may not have claim to any fundamental right bestowed by the constitution of India.

The current investigation of the Directorate of Enforcement have found the Chinese instant loan apps, working in collusion with Indian NBFCs, siphoned criminally acquired money outside India through Indian crypto-exchanges. A major chunk of money was allegedly transferred through WazirX, stated a press release issued by the ED.

Moreover, NBFCs are entities regulated by the RBI. The central bank had already expressed similar apprehensions to the Supreme Court during the case proceedings, which are coming true now.

On the other hand, the Supreme Court Judgment Para 6.167 mentions that one of the important aspects of their assessment was that the RBI had not proved the activities of crypto-exchanges to have actually adversely impacted the functioning of the entities regulated by the RBI. This means that one of the main reasons for the RBI losing the case was due to the lack of factual proofs.

With the latest issues of crimes and consumer insecurity surfacing in the crypto ecosystem, the RBI may have factual proof to back its actions against crypto entities in the future.

It remains to be seen whether the central bank will again take a stand to defend the sanctity of the Indian economy and the rights of its people, or whether it will appear to be as indifferent as the government.

A questionnaire by Fortune India sent to the RBI on this issue remained unanswered despite repeated requests.