RBI MPC meet: Economists expect 'status quo', 1st repo rate cut likely in December 2024

A stance change is possible if food inflation outlook turns favourable on a normal distribution of rains in the second half of monsoon and in the absence of global or domestic shocks, says economist

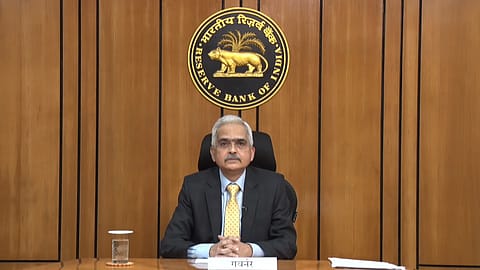

Several banks and brokerages expect the Reserve Bank of India (RBI) to keep the 'status quo' when it comes to key lending repo rates in its upcoming Monetary Policy Committee (MPC) meeting, primarily due to high food prices. Analysts say the RBI could also continue its "withdrawal of accommodation" stance in the short term in the wake of high growth and higher inflation. The RBI's MPC deliberation starts tomorrow and the committee will announce its decisions on August 8, 2024.

Aditi Nayar, chief economist, ICRA, says high growth in FY2024, combined with the inflation of 4.9% in Q1 FY2025, are "unlikely" to shift the voting pattern of the four members who voted for a "status quo" in the June 2024 meeting towards a change in stance or rate cut this time.

"If the food inflation outlook turns favourable on the back of a normal distribution of rains in the second half of the monsoon season, and in the absence of global or domestic shocks, a stance change is possible in October 2024. This could be followed by a 25 bps rate cut each in December 2024 and February 2025, with an extended pause thereafter," she says.

SBI Research's Soumya Kanti Ghosh writes the RBI's stance should continue to be the withdrawal of accommodation. "RBI is likely to pause as food price movements currently is imparting a positive bias to RBI 4.5% projection…likely prospects of an excess rainfall in August and September could also have a debilitating impact on food prices."

He adds that a higher neutral rate at 1.4% -1.9% could mean wait for rate cut by the RBI could get longer. "First cut likely in Dec 2024/Feb 2025…any disintegrated rate cut and change in stance could front load market movements one way up."

On the global economy, Ghosh says the biggest concern, jolting the markets (inter-alia the investors) is the probability of the U.S. entering a recession. "US job market now looks much weaker with downward cumulative payroll revisions at 4.91 lakhs since 2023 till date."

He adds the political risk will dominate course of the U.S. in H2 2024 as the nation would be highly polarised on key issues having a bearing on future prospects for EMs along trade or protectionism measures. Additionally, the Chinese economy has shown a "resurgence" with growth likely to pick up in both 2024 and 2025, says the SBi Research report.

The RBI has kept key lending rates unchanged for the past 17 months since February 2023. Between May 2022 and February 2023, the repo rate was hiked six times from 4 to 6.5%.

In June 2024, the RBI had decided to maintain the "status quo" on key repo rates by keeping it unchanged at 6.5%. This was the eighth time in a row the RBI committee decided to keep the repo rate unchanged. The MPC also revised its GDP forecast for FY2024-25, upgrading the estimates to 7.2% from 7% earlier.

India's retail inflation increased to 5.08% in June 2024, compared to 4.80% in May, owing to higher food and beverage inflation. The RBI in its last MPC meeting in June had said growth was holding firm, and that inflation continued to moderate, mainly driven by the core component, which reached its lowest level in the current series in April 2024.