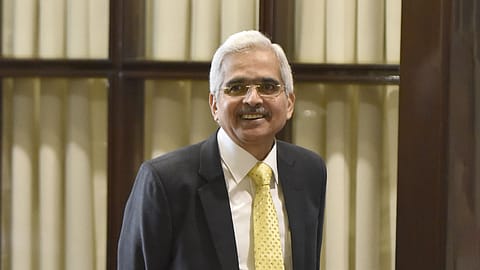

Rupee depreciation among lowest in the world: RBI governor

The Indian rupee has depreciated by 5.1%, which is among the lowest in the world, says RBI governor Shaktikanta Das.

The Indian rupee has moved in an orderly manner in the ongoing financial year and held its own in a world of sharp depreciation across other currencies of emerging market economies and advanced economies, according to Reserve Bank of India (RBI) governor Shaktikanta Das.

While the US dollar has appreciated by 11.8% during the current financial year so far, the INR has depreciated by 5.1%, which is among the lowest in the world, Das pointed out while addressing an event organised by the Fixed Income Money Market and Derivatives Association.

“Our endeavour amidst the extraordinary events unfolding globally on an ongoing basis has been to anchor expectations and allow the exchange rate to reflect the fundamentals rather than overshoot,” the RBI governor says, adding that exchange rate stability is an intrinsic element of the central bank’s overall macroeconomic and financial stability.

The RBI is in the market on a regular basis, providing liquidity and confidence so as to facilitate its smooth and normal functioning, Das says.

Avoiding undue and excessive volatility is a desirable policy objective for all stakeholders, while reaping the benefits of a market determined exchange rate regime, he adds.

The recent softening of commodity prices and supply chain pressures have eased the terms of trade shock that India faced in the aftermath of the pandemic and the war, says Das.

“With the consequent easing of imported inflation pressures, India’s CPI inflation has peaked in April 2022. Further, the average Indian basket crude price in August at $97.4 per barrel has turned out to be lower than what we had assumed for the full year - $105 per barrel - in the monetary policy resolution of August 5,” he says, adding that India’s inflation is lower than a large number of its trading partners.

Recommended Stories

While the incoming monthly inflation prints in the near-term could be bumpy, Das expects it to moderate in the second half of 2022-23, and then move within the tolerance band in Q4 and then even lower in the first quarter of 2023-24.

The shift in the commodity price outlook is also altering the assessment of India’s current account deficit in 2022-23, which is now expected to remain well within sustainable levels.

The recent commentary from the US Fed at Jackson Hole on the future trajectory of US monetary policy has infused substantial volatility into global financial markets, with large spillovers and knock-on effects on emerging market economies, says Das.

Going forward, the central bank’s monetary policy will remain watchful, nimble-footed and calibrated in order to ensure price stability while supporting growth, says Das. “The RBI remains committed to support the market with two-way operations, as warranted, in line with the revised liquidity management framework. The RBI will also strive to ensure stable money market conditions, the smooth conduct of the primary auctions in G-secs and facilitate the orderly evolution of the yield curve,” says Das.

(INR CR)