The Books I loved in 2023: Devina Mehra

Restricting myself to broadly Business/Finance/ Economics books, the task is a tad easier

This is always both a hard and a fun annual piece for me to write!

Hard because it is difficult to pick a handful from the many interesting books every year - 54 this year. And books are always fun.

Restricting myself to broadly Business/Finance/ Economics books, the task is a tad easier. With very few exceptions, I generally don't read the management/ leadership/ self-help variety. So that eliminates a chunk of what passes for non-fiction these days.

Now coming to my ‘Best of 2023’ list.

The first two books, which coincidentally are from my favourite authors, are the clear joint firsts - after that the order in which the books appear is a bit random.

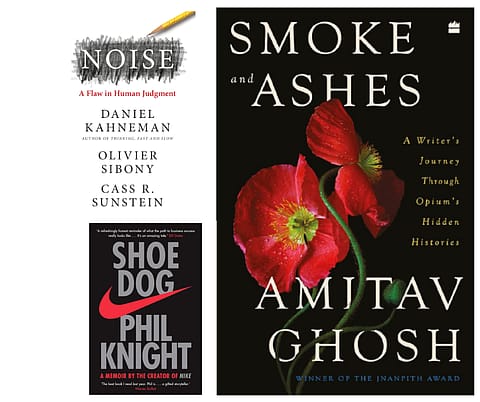

1. 'Noise: A Flaw in Human Judgment' by Cass R. Sunstein, Daniel Kahneman & Olivier Sibony

It took me a few months to make my way through one of most the complex, juicy and rewarding books I have ever read. It goes right besides Kahnemann's ‘Thinking Fast and Slow’ into my all time top 5.

Recommended Stories

Difficult book to summarise because it is choc-a-bloc with ideas.

Each chapter covers as much as a normal non fiction book does.

One key takeaway: a well-designed system or algorithm will always outperform a human expert in areas as diverse as judicial decisions, medicine and of course, investing.

Why? Because human beings, or rather their judgements, introduce not just biases but also noise, which is variation from person to person and also across time or circumstance for the same person.

(INR CR)

Just think, won't a fight with your spouse or in the traffic in the morning impact how you look at the same data as a finance analyst or whether you or not you will give bail as a judge.

Several other questions dealt with. For example:

● Whether more heads add wisdom or craziness?

● Should you abandon a system that is making mistakes in reading mammograms or for that matter giving a wrong decision in a cricket match?

● Why is everything easy to explain once it has happened?

A book that takes a long time to read because it makes you think.

2. 'Smoke and Ashes', by Amitav Ghosh

The riveting story of Opium and its impact on human history.

What is a book about the history of opium doing in a business book round-up?

Before coming to that, let us first let us answer a quiz question:

Which was the biggest drug cartel in human history?

It was the East India company and the British Raj, not that other colonizers were for behind.

The business angle? Royal Dutch/ Shell, BHP Billiton & the Dutch royal family also all have their origins in the drug trade...as this was a general colonial template, not exclusive to the British.

Besides of course, the Parsi (and Tagore) fortunes of India and the 'venerable' Hong Kong firms like Jardine. And more recently, several pharma fortunes. But it is deeper than even that.

Free trade. Free markets. Globalisation. All the pillars of the current economic system.

But it wasn't Free trade or the autonomous laws of the market that laid the foundations of the globalized economy, it was a trade that was:

● Monopolistic

● In an addictive drug

● Under colonial administration with farmers and workers having no freedom at all

● Where military strength was used for forcible cultivation and smuggling/ drug-pushing

● The very opposite of free trade and rule of law that the West is supposed to have brought to the natives

Even the 'Old money' in the US...the so-called Boston Brahmin families mostly owe their fortunes to the China trade. The same US East Coast elite whose names are there on everything from business enterprises to Universities.

Many of the cities that are now pillars of the modern globalized economy & finance: Mumbai, Singapore, Hong Kong and Shanghai - were initially built and sustained by opium.

Opium, in short, has been one of the biggest players in history, including business history, that you have never heard of!

It is a fascinating but macabre story.

Meticulous research and great writing as always from Amitav Ghosh.

3. ‘Shoe Dog’, by Phil Knight

Finally read Nike founder Phil Knight's 'Shoe Dog'. Every bit as good as its reputation.

As always, one realises much of what you think you know about a business is not really so.

For instance, it took a good 20+ years for Nike to become a real success story and yes the marketing poster boy company came from origins where the accountant founder was not really convinced that his shoes needed marketing. Or that he should spend on something where the outcome was not measurable.

The ghost writer is absolutely brilliant (same one for Agassi's Open & Henry's Spare).

Besides the story itself, what enviable writing - like most such, it's the interior dialogue that delights. This one had me cackling away on a flight.

Of course at some level you know that no one will really remember in detail what they were thinking about on a jog or a flight 50 years ago, so much has to be fictional, but the writer makes you believe in that magic.

4. ‘What the Dog Saw’, by Malcolm Gladwell

The strange thing about this Malcolm Gladwell book is that while in his previous books even when the material was weak, his writing quality kept you going, in this one the first few chapters were actually heavy going.

But since it has write-ups on 20 + topics there was enough meat there to understand and apply to the real world.

There are of course business stories from what makes for an outstanding salesperson to Nassim Nicholas Taleb’s view of uncertainty and risk.

But there is other stuff too that makes you think:

Like whether India's cricket defeat in the World Cup finals was a case of choking or panicking - two completely opposite neurological pathways that may lead to the same real world outcome of failure.

Or why ‘obvious’ clues in Business or terror intelligence are missed.

Or why do risk reduction measures, like superior braking or seatbelts, never give the expected reduction in accidents.

Plus there are obvious parallels even when Gladwell is talking about something else.

"He seems to have understood only that if you make a great number of predictions, the ones that were wrong would soon be forgotten and the ones that turn out to be true will make you famous.”

Gladwell is talking about forensic psychiatrists (those who gave magically accurate descriptions of serial killers BEFORE they were caught) but he could just as well have been talking about financial market experts who pontificate everyday on TV and in research reports, predicting things they objectively can't.

5. ‘The Art of Thinking Clearly’, by Rolf Dobelli

Cognitive biases and foibles in thinking are among my favorite topics to read about. But several books, including those by Kahnemann, are not easy reads.

'The Art of Thinking clearly' is an answer to your prayers if you are looking for something covering human biases, errors & thinking gaps in an easy to read format.

There are no footnotes, references to academic studies or bibliography although obviously it must be based on many books. It is almost like a Kunji or Cliff Notes version of a textbook. Each error is explained simply and clearly in about 3 pages.

From Survivorship Bias to Groupthink, from Ambiguity Aversion to Cognitive dissonance, it's all there - in painless, bite-sized pieces.

6. ‘Statistical: Ten Easy Ways to Avoid Being Misled By Numbers’, by Anthony Reuben

This is about how to read, interpret, analyse and shred the numbers that are all around us.

What they really mean? What are they hiding? What are the assumptions behind them?

How to manipulate survey results?

How to estimate loss to the economy for a rained out or snowed out day?

Can per Capita income go up even as median income goes down?

How to estimate the ‘real’ cost of VIP security?

How to think about marginal costs?

These are the type of questions this book addresses.

Being less than fully numerically literate has a cost - often a hefty one. This book helps you distinguish statistical fact from fiction. A must-read, if only as refresher.

7. ‘Big Bull of Dalal Street: How Rakesh Jhunjhunwala Made His Fortune’, by Neil Borate, Aprajita Sharma, Aditya Kondawar

This book is important because India has been particularly poor in recording the history of businesses and markets.

This was a commmendable effort to record the life and times of one of the larger-than-life figures in the Indian stock markets while memories were still fresh.

The book is not without its flaws, including the fact that it does not really analyse the fact that Jhunjhunwala bought hundreds of stocks and only a small handful were responsible for almost his entire fortune.

One line that stood out from the book for me which is a throwaway line in it:

"Not every year I make money. I make money in spurts, like 1989-92, 2003-07, 2009-11.

In 1994-99 I would'nt have made any trading income"

To me this was Jhunjhunwala’s superpower: to understand & act on the fact that stock market returns are lumpy.

If you remain disciplined through downturns, or frustrating sideways moves which can go on a long time when you're living through them, you'll be way way ahead.

Worth a read.

8. ‘The Lessons of History’, by Ariel Durant and Will Durant

Yes history, because economics is not that divorced from human history as we sometimes think. Read Chanakya or look at grafitti on Pompeii walls and you realise human beings have not changed much in a thousand years - not even in their economic behavior.

This is a slim book but takes time to read as you often shut it and think about what has been said.

This, after all, is the distillation of decades of studying thousands of years of history.

We are familiar with economic or business cycles but as this books sets out almost all patterns in the world religiosity vs atheism, authoritarian vs liberal, higher bargaining power of capital vs labor, all types of different economic & political systems move in cycles. And, these cycles have been repeating for thousands of years.

I found it illuminating and also liberating - you are but a tiny speck in history!

9. ‘Bulls, Bears and Other Beasts: A Story of the Indian Stock Market’, by Santosh Nair

Another one about history, this time of the Indian stock markets with many real names from Manu Manek and Ajay Kayan, to Harshad Mehta and Ketan Parekh, and some thinly disguised ones; this is about the rollercoaster of almost 3 decades of Dalal Street.

Has a real time, living through it feel as it is apparently based on the author's daily diaries of those years. Not always completely accurate but close enough.

Also a reminder that the more things change, the more they remain the same.

"India growth story"

"Foreigners HAVE to flock to India"

"India is fastest growing economy; beating China"

Sounds familiar?

Obviously a collection of recent newspaper headlines, right?

Wrong!

It's a description of a stock market party for the 2008 New Year.

Lots more of this type of deja vu, from rigged stocks to IPO frenzies. Plus much that has disappeared into the fogs of time like the open outcry trading ring of the BSE.

This one is for the stock market buffs and might drive them to misty-eyed nostalgia.

10. ‘Wings to fly’, by Deepak Sharma

I will round up the top 10 with what is a beyond business book. So you have excelled academically, then had a great professional career, but is there all there is?

Some of us vaguely ask ourselves this question but here's the story of Deepak Sharma who actually did something about it.

He gave up a flourishing corporate career in his early 50s for full-time volunteering, with as much dedication as he showed in his career (for example going for every parent teacher meeting of every single child under his care).

His wife, who is a doctor, has been running the house since. His mother contributed all her lifetime savings for girls' education.

It is a simply written but greatly inspiring story of making a difference to many lives. A possible path for all of us pursuing business success.

This rounds up my Top 10 for the year.

In the almost made it category are:

‘Roller Coaster’, by Tamal Bandyopadhyay

Which is the inside track on Indian banks, bankers and central bankers over the last few decades - the personal quirks, the shady deals, the business building, the gossip, the missed promotions, the top job appointments etc.

And

‘Supermarketwala: Secrets to winning Consumerism India’, by Damodar Mall.

Which is about understanding the Indian consumer through painstaking observation; to take nothing for granted, to not cut paste learnings and formats from other parts of the world but to actually see how the Indian shopper shops, with whom, how they move through a shop, where they store things at home, the cooking sequence they follow etc - all of which provide insights to both manufacturers and sellers of consumer goods. A very different viewpoint, with some very unique takes.

Happy reading!

(Devina Mehra is the Founder and Chairperson of First Global, a leading Indian and Global investment Management firm. She is a gold medalist from IIMA and has been in the Investment business for over 30 years. She tweets @devinamehra and can be contacted at info@firstglobalsec.com or www.firstglobalsec.com)