Binance raises $500 million to boost Web3 as crypto sinks

The new fund will invest in projects that can extend the use cases of cryptocurrencies and drive the adoption of Web3 and blockchain technologies.

Binance, the world's largest crypto exchange by volume, announced the closing of a new $500 million investment fund on Wednesday.

The new fund will invest in projects that can extend the use cases of cryptocurrencies and drive the adoption of Web3 and blockchain technologies.

This comes at a time when cryptocurrencies like Bitcoin and Ethereum have seen their prices sink in 2022. Bitcoin has tanked over 50% after reaching an all-time high of around $69,000 in November.

The fund is supported by global institutional investors such as DST Global Partners, Breyer Capital, as well as other major private equity funds, family offices, and corporations as limited partners.

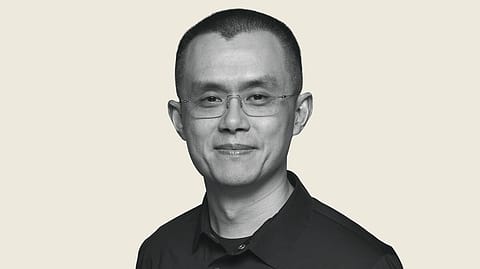

"In a Web3 environment, the connection between values, people, and economies is essential, and if these three elements come together to build an ecosystem, that will accelerate the mass adoption of the blockchain technology and crypto," says Changpeng Zhao ‘CZ’, founder and CEO of Binance.

"The goal of the newly closed investment fund is to discover and support projects and founders with the potential to build and to lead Web3 across DeFi, NFTs, gaming, Metaverse, social, and more," he adds.

Since 2018, Binance Labs, the venture capital and incubation arm of Binance, has invested in and incubated more than 100 projects from over 25 countries. Its portfolio includes industry-leading projects such as 1inch, Audius, Axie Infinity, Dune Analytics, Elrond, Injective, Polygon, Optimism, The Sandbox, and STEPN.

Recommended Stories

Binance Labs makes investments across three different stages: incubation, early-stage venture, and late-stage growth.

With incubation, Binance Labs aims to connect projects with Binance’s network of resources, experts, and mentors to help them drive successful product development and growth. Binance Labs runs its Incubation Program regularly and is currently supporting its fourth cohort.

Early-stage venture investments include token and equity investments across all sectors of cryptocurrency and Web3, including infrastructure, DeFi, NFTs, gaming, Metaverse, social, and crypto adoption platforms.

Late-stage growth investments target more mature companies looking to scale or bridge into the Web3 ecosystem with the Binance ecosystem as a solid strategic partner.

(INR CR)

The $500 million investment fund announced today is expected to be allocated to projects spanning all three stages.