Covering all bases

ADVERTISEMENT

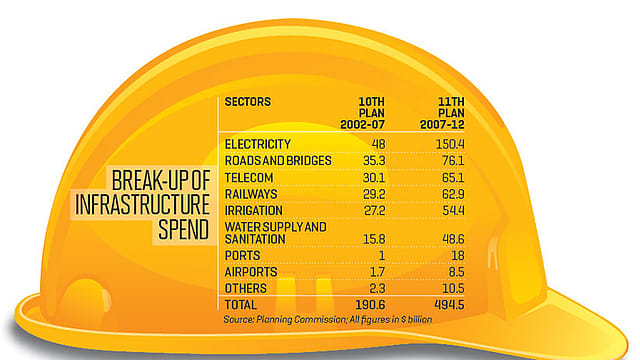

INDIA MAY HAVE BEEN slow off the blocks in infrastructure development, but with the government planning to spend nearly $500 billion (Rs 22.2 lakh crore) on the sector as part of the 11th Five Year Plan (2007-12), interest is increasing. The opportunity gets bigger: The allocation for the following five-year period is $1 trillion, of which half is expected to come from the private sector through moves like public-private partnerships, as in the case of airports.

To meet the rest of this massive outlay, the government will need to tap private capital. This augurs well for infrastructure companies, and for the CNX Infrastructure Index, which has consistently under-performed relative to the CNX Nifty.

Even if all 25 stocks in the infrastructure index don’t get the anticipated boost, it’s still possible to profit from the sector, for high net worth investors (HNIs), at least. Private equity funds, such as Macquarie SBI Infrastructure Fund, managed by SBI Macquarie Infrastructure Management, bet big on unlisted infrastructure firms. Most of these firms are in the early stages of growth, and would likely be undervalued if they list now. With infusions of smart money (from institutions and HNIs), they could grow to a size where it makes sense for them to be listed.

“These funds are attractive as they help investors enter infrastructure companies at lower valuations than listed stocks,” says Varun Bajpai, CEO, SBI Macquarie Infrastructure Management. IDFC Project Equity, which manages the Rs 3,800 crore India Infrastructure Fund, takes a similar approach. However, these funds are not for retail investors, and the shareholding patterns and portfolios are closely guarded. “Private equity funds are not really liquid,” explains M.K. Sinha, president and CEO, IDFC Project Equity. “They’re meant for those who have an appetite for illiquid investments.”

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

Retail investors who want liquidity (at a smaller initial investment) also have options in the infrastructure space, apart from investing directly in stocks. Mutual funds have a range of infrastructure funds on tap. Of the total Rs 6.92 lakh crore worth of assets under management across all mutual funds in India, infrastructure funds account for Rs 20,000 crore. The big infrastructure funds—ICICI Prudential, DSP BlackRock, UTI, and Tata mutual funds—account for Rs 9,070 crore. Take ICICI Prudential Infrastructure Fund and DSP BlackRock India T.I.G.E.R. Fund (The Infrastructure Growth and Economic Reforms Fund). With net asset values of Rs 33.16 and Rs 54.17 (returns on every Rs 10 invested) respectively, these funds invest in bankable stocks like Larsen & Toubro and Bharat Heavy Electricals. Other funds chase recently-listed entrants like GMR Infrastructure, GVK Power and Infrastructure, and Reliance Power, which have taken a beating on the bourses. Infrastructure has no uniform definition in India; the indices include telecom companies, for instance, while some funds do not.

Given the nascent stage of Indian infrastructure, returns will call for some patience. “Factors like policy hurdles will also need to be considered,” adds Nilesh Shah, deputy managing director, ICICI Prudential Asset Management Company.

The infrastructure story, though, can still build up nicely.