Five year review of the Fortune India 500 list

ADVERTISEMENT

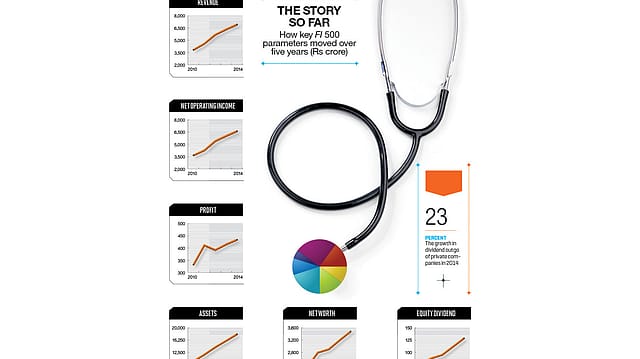

Sifting through the past five years’ Fortune India 500, the ultimate performance indicator of India’s leading corporations, reveals that they have held up remarkably well notwithstanding brief periods of slow growth. Revenue and profit have expanded at five-year compounded annual growth rates (CAGR) of 12.7% and 5.58%, respectively. And shareholders have been rewarded with over 1.68 times increase in dividend, which has registered a CAGR of nearly 11% since 2010.

Comparing the bottom of the list in the first year of this exercise and now gives a sense of how things have evolved: The first Fortune India 500 saw Elecon Engineering bringing up the rear, with Rs 1,055.83 crore in revenue and Rs 66.95 crore in profit. This year, Persistent Systems holds that spot with Rs 1,700.17 crore in revenue and Rs 249.28 crore in profit. In CAGR terms, revenue and profits of the 500th company have grown at 10% and 30%, respectively, over the five years.

In the following pages, we give you glimpses of the leaders and laggards on financial parameters beyond what we have covered in the 500 tables. From top CSR spenders to the most effective advertisers, and from highest-remunerated boards to promoters with the highest-pledged shareholding, these trends will give you an analyst’s view of the companies.