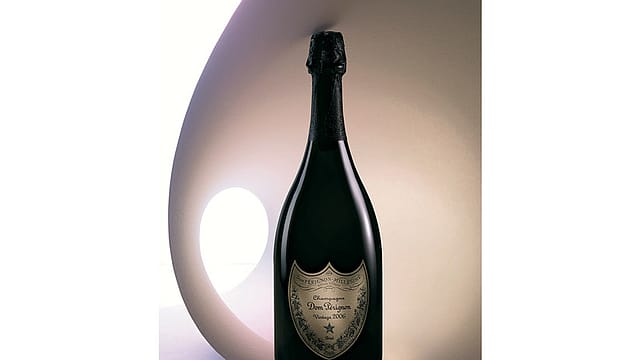

Daring to be Dom

ADVERTISEMENT

Encircled by unspoiled vineyards and historic hillsides, Épernay is home to some of the most famous champagne labels. Millions of bottles of Moët & Chandon, Pol Roger, and Perrier-Jouët are gracefully ageing in 30 km of cellars beneath the town. But Dom Pérignon, from the house of LVMH Moët Hennessy Louis Vuitton, is perhaps the most exclusive and secretive.

This is my second visit to the bucolic town of Épernay, about 100 km from the frenzy of Paris. I’ve returned to the champagne trail after three years to solve one of the enduring mysteries of the luxury world: How is it Dom Pérignon, without a vintage since 2006, remains the king of its trade? For the past two decades, I have written about luxury brands from around the world. Many attempt to shroud themselves in mystery, but few succeed. Dom Pérignon, which celebrates its 80th anniversary this year, is one of those elite brands.

Its lofty status is perplexing, not only because the champagne industry has suffered sluggish growth over the last decade, but also because it is something of an anomaly. Ever since the recession altered shopping patterns in 2007, luxury brands have been more desperate than ever to carve out an identity. Not Dom Pérignon. It always exudes self-confidence; it has even allowed—the newest vintage is a decade old already—the longest gap between two vintages in its recorded history.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

Until the global recession in 2007, anything suitably hyped-up could sell at any price. The downturn redefined value in luxury. Customers were still willing to pay a premium, but only for authenticity, which—to adapt a Wildean adage—is rarely pure, and never simple.

Many brands built on hype nearly collapsed; Versace, for instance. While luxury outperformed most other asset classes as the rich continued to spend, there was a greater emphasis on product. The brands that emerged largely unscathed—Hermès and Dom Pérignon—prided themselves on their “authenticity”: The CEO of snooty French heritage label Hermès once told me that they don’t sell goods, they sell “history”.

The crisis forced champagne houses to wake up to a peculiar paradox in their business: the most premium varieties come from big houses, rather than obscure producers. Perhaps the seminal industry text, Business of Champagne: A Delicate Balance, edited by Steve Charters, a wine educator at The Institute of Masters of Wine in London, summarises this phenomenon: “In most wine regions the most expensive wines tend to come from small producers who only produce a very limited quantity of their product… In contrast, in champagne the highest-priced wines are those that come from the largest companies producing enormous quantities… thus, the brand itself is setting the price rather than the uniqueness and rarity of the wine.” At the forefront of this shift was Dom Pérignon.

To be certain, the industry has endured tough times. Prosecco, a reasonably-priced Italian sparkler, and Spain’s cava, have emerged as challengers to champagne’s dominance in sparkling wines. (Champagne is made from three varieties of grapes—chardonnay, a white wine grape, and pinot noir and pinot meunier, both red wine grapes. Dom Pérignon only uses pinot noir and chardonnay. Prosecco is made from glera grapes. For a wine to be called champagne, it has to be made in the eponymous region in north-east France. Champagne’s fizz is produced from trapped carbon dioxide inside the bottle released while the wine is fermenting.)

By 2014, prosecco sales had overtaken champagne globally, led by gains in Britain, the largest importer of champagne. For the first time in 2014, shoppers in Britain spent more on the Italian sparkling wine—£181.8 million (Rs 1,608 crore) to be precise—than on the French bubbly (£141.3 million), according to market researcher Kantar. In the U.S., the world’s second-largest importer of champagne, prosecco sales grew by 36% last year while champagne sales rose a meagre 8%, per a report by market researcher Nielsen. Even after taking into account that champagne has cornered 20% of the sparkling wine market in the U.S., compared with prosecco’s 14% share, the Italian sparkler has made substantial inroads.

Chef de Cave Richard Geoffroy.

One of the reasons prosecco is gaining ground is price. Prosecco retails for $12 a bottle (Rs 804), whereas champagne sells at $52 a bottle on average, according to Nielsen. Prosecco’s popularity is growing so fast that it has prompted warnings of possible shortages. In France, the world’s top champagne market, sales of the local bubbly have remained lacklustre year after year since the economic downturn.

Then, there is the sticky issue of climate change that threatens grape harvests every year. At the moment it isn’t a problem, as Dom Pérignon’s Chef de Cave Richard Geoffroy points out: “We have been witnessing riper and softer fruit in the past 15 years. This actually serves our purpose as our wines are thriving on the richness and concentration.” But scientists, including those at the National Institute for Agricultural Research in France, have noted that the temperature rise in the Champagne region is higher than the global average (around 2° C) over the last 50 years. The temperature rise in the grape growing season between April and September might be even higher.

To protect against the vagaries of weather and manage fluctuations in demand, LVMH’s champagne houses keep significant reserves of wines in its cellars: As of December 31, 2015, the number of champagne bottles in stock stood at 208 million, the equivalent of more than three years of sales. This is in addition to 83 million wine bottles still in storage tanks waiting to be drawn.

Despite the recent turbulence, there is a feeling things are looking up. Since 2013, champagne sale volumes have inched up 2.4%. LVMH, which owns 21 wine and spirits brands that stretch from Dom Pérignon to Belvedere vodka and Ardbeg whisky, has fared better over the same period, selling 9.6% more bottles of its bubbly brands that include the world’s oldest champagne house Ruinart, Moët & Chandon, Mercier, and Krug.

Champagne houses clocked their highest revenue in 2015 when global sales touched €4.7 billion (Rs 35,589 crore), crossing their earlier record of €4.56 billion in 2007, according to industry body Comité Interprofessionnel du Vin de Champagne. In 2015, LVMH’s revenue from champagne and wines rose nearly 12% to €2.2 billion from last year. Rival Pernod Ricard sold 300,000 cases of its flagship Perrier-Jouët champagne last year, up 9% by value from a year earlier.

In the first half of the current calendar year, LVMH’s champagne and wine division continued to grow, with sales rising 3% to €856 million. More impressively, profit from recurring operations for wines and spirits surged 17% to €565 million, with champagnes and wines raking in €178 million. One of the reasons is spelt out in the company’s press release for the period: “The prestige vintages performed particularly well.”

LVMH’s alcohol business has helped offset some of the reversals in the fashion and leather goods space. (In the first half of 2016, LVMH’s fashion and leather goods was the worst performing division. In an unusual retreat in July, the company offloaded its floundering Donna Karan brand for $650 million, including debt.)

LVMH does not reveal numbers for Dom Pérignon or any of its other alcohol brands, not even the brand’s biggest markets. All we know is the crème de la crème of society seldom look beyond Dom Pérignon to celebrate landmarks in their lives—birthdays, sporting triumphs, romantic evenings, and so on.

“From New York to Tokyo to London and beyond, we are honoured by the countless numbers of Dom Pérignon lovers around the globe,” is all the information Bertrand Steip, Moët & Chandon’s international commercial director, volunteers when pressed on how many customers the brand has worldwide. Steip says the highly competitive champagne market—with 306 champagne houses and more than 4,400 wine growers that employ nearly 16,000 people—makes it difficult to provide such estimates.

Ed McCarthy, the author of Champagne for Dummies, writes: “No one except Richard Geoffroy, cellarmaster of Dom Pérignon, and a few trusted associates of Moët & Chandon, its parent house, knows the exact number of bottles Dom Pérignon produces each vintage.”

Few brands have been able to emulate the impenetrable Dom Pérignon in protecting their secrets. According to McCarthy, at least three million bottles of Dom Pérignon are produced in most current vintages, but it could be four million bottles or more. (Parent LVMH sold 62.7 million bottles of champagne in 2015, according to the company’s annual report.)

The brand has grown even more secretive since I last visited. It no longer allows visitors into the cellars. (Instead it offers customers an experience called Atelier Dom Pérignon: No more than a dozen guests, for a cool $671 a head, are given a one-day tour of the winemaking process. No freebies for journalists, unfortunately.)

Aside from secrecy, Dom Pérignon has built its reputation on an unbending quest for quality. It requires the best grapes from a single year; it dares not to release a vintage when the harvest doesn’t meet its ideals. (That’s why there isn’t one since 2006.)

Dom Pérignon divides the life cycle of its champagnes in three ‘plénitudes’ —the first, on release, the second after about a decade, and the third, around 20 years later. In what became a headlining event in 2014, it released P2, a second plénitude of its vintage from 1998 (around $375 a bottle). On the Atelier (which translates to ‘workshop’ in English), customers can taste the Dom Pérignon P2, along with vintages from 2004 or 2005, the P3 1990, and the Rosé from 2003.

Says McCarthy: “No other champagne impresses me more than Dom Pérignon… But my premise is based on the very fact that Dom Pérignon’s production is huge, and yet its quality remains so high that it consistently ranks among the top champagnes, vintage after vintage.”

Axelle Araud, Dom Pérignon’s chief winemaker, can only hope to make at most six vintages in her entire career. The label only releases vintages or special years. Generally produced three or four times a decade, vintages must be made entirely from grapes harvested in the year indicated on the label. When the grapes are of exceptional quality, it is called a special year. Non-vintage (NV) champagnes, in contrast, can use wines from as many as 10 years earlier to achieve a desired style.

Dom Pérignon champagne needs a minimum of 10 years, and often 20 years, to truly come of age. “When you look back and think that the whole of your life’s work will just be a few bottles, these few vintages, your notion of time changes,” Araud muses. No wonder oenologists (oenology is the science of wine) seem obsessed with time.

History and time entwine across the lush vineyards and slopes of Champagne: a battleground since the defeat of Attila the Hun at Chalons-sur-Marne in 451, also the place where Napoleon fought his last battles and bestowed his own cross of the Legion of Honor on the mayor of Épernay, Jean-Rémy Moët, a loyal friend, a day before the city fell to Russian and Prussian troops in the spring of 1814.

Épernay is one of Champagne’s three main towns, along with Reims and Troyes. Flâneurs traverse its twisting, dizzying alleys that seem to be designed to give you a sense of what happens when you drink too much champagne. (Not everyone agrees. Mark Twain famously said: Too much of anything is bad, but too much champagne is just right.)

There is a ghostly silence in Dom Pérignon’s offices. Everything seems understated in hues of cream and grey. The soft-spoken guides, or “ambassadors” as they call themselves, are dressed in secret-service black suits and are versed in the history of the brand.

Dom Pérignon’s home abuts a monastery, the Abbaye Saint-Pierre d’Hautvillers, where I have lit two candles. This is where 17th century monk Dom Pierre Pérignon—a contemporary of France’s Sun King Louis XIV who built the lavish Palace of Versailles—pledged to create the “best wine in the world”.

Pérignon, the father of modern champagne, introduced many things still relevant in winemaking today—thicker bottles for champagne to prevent them from bursting, and cork instead of wood to keep the wines fresher (he used to soak it in oil and tied it with rope). “Come quickly, I’m tasting the stars,” the monk allegedly urged when tasting the first sparkling champagne.

In 18th-century Champagne, vintner Claude Moët, the founder of the house that would later become Moët et Chandon, decided to build on the work of Pérignon. In 1971, Moët merged with cognac maker Hennessey, and 16 years later, fashion major Louis Vuitton bought the alcohol group, creating LVMH. Since then, Dom Pérignon has been the jewel in the crown of LVMH, the world’s biggest luxury conglomerate (revenue of nearly €36 billion in 2015).

Dom Pérignon is what the Shah of Iran served in 1971 to celebrate 2,500 years of the Persian Empire. Guests drank Dom Pérignon at the wedding of Diana and Prince Charles in 1981, the so-called Wedding of the Century. It regularly pops up in lists of the most expensive drinks in the world—special bottles can fetch more than $5,000 for a 750 ml bottle, and the average price for a 2004 or 2006 vintage is around $170 a bottle in the U.S. That’s why Stockholm-based Richard Juhlin, the world’s foremost champagne expert, calls it “the wine world’s strongest brand”.

Charles Dickens wrote: “Champagne is simply one of the elegant extras in life.” Dom Pérignon embodies that less-is-more elegance. The secret? Despite all the challenges, Dom Pérignon hasn’t strayed from its principles: patience, secrecy, and perfection.