HDFC Bank’s Merger Pangs

India’s second-biggest bank may not be the cynosure of investors as the merger with HDFC weighs heavy, shaving off 16% of its market cap. But who can afford to ignore the 800-Pound gorilla?

This story belongs to the Fortune India Magazine March 2024 issue.

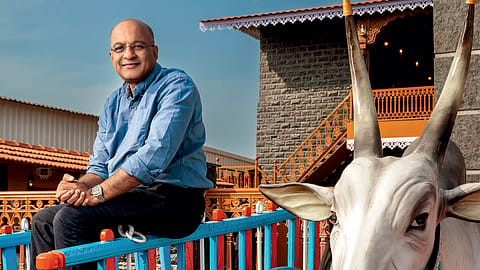

ON A WARM DECEMBER afternoon even as the sun blazes in a cloudless sky, there is a distinct buzz at Hotel Shauryawada, a restaurant located in the burgeoning outskirts of Pune in Wagholi, serving authentic Maharashtrian cuisine. Senior executives of HDFC Bank — the world’s 11th-largest bank by market capitalisation at $136 billion — are milling around in the premises that are decked up for what appears to be a grand convergence. Just as the clock ticks past the scheduled time of arrival, amplifying the collective sense of waiting, a bus finally rumbles onto the gravel-strewn foyer of the hotel.

Amid the beating of dhols and blowing of the tutari, a traditional trumpet associated with Maratha rulers, the bus doors swing open. Out steps the 55-year-old CEO of HDFC Bank, along with an entourage of senior officials. At the entrance, the hotel owner, who is also a customer of HDFC Bank, ceremoniously adorns Sashidhar Jagdishan, dressed in smart casuals, with a traditional Maratha pagdi (turban), resplendent in red and gold. Jagdishan, who joined the bank in 1996 and ascended through the ranks to become the CFO in 2008 and CEO in 2020, appears at ease despite the long winding journey from Kolhapur to Pune.

After savouring an all-veg lunch, the CEO is back on the bus, which will head to Nashik, rounding off a three-city bus trip spanning over five days. A refreshing blend of grassroot insight and top-tier management, the ‘meet-on-wheels’ excursions are now a regular feature on Jagdishan’s calendar. It’s a practice that not only distinguishes him from his predecessors, but also cements his desire to understand the opportunities and address the challenges in an ever-evolving financial landscape for the 28-year-old bank, which set up its first branch at Worli in Mumbai in 1995.

How the road trips have helped the bank tap into new opportunities is interesting. For instance, on a recent trip from Madurai to Kanyakumari, the CEO visited a local chilli mandi (wholesale market), only to find that a public sector bank was enjoying a virtual monopoly among traders. HDFC Bank didn’t have any business with these traders, who were typically intermediaries who bought produce from farmers and sold it in the market. Jagdishan advised his team to consider extending credit to these seasoned traders, some of whom have been in business for nearly a century. After a five-member senior team spent some weeks at the mandi to make on-site assessments and estimate incomes, a new credit framework for mandi traders was rolled out across the country. "Jagdishan felt that lending credit to those who have been in business for nearly a century was trust-worthy, but he didn’t want to influence our decision," says a senior bank executive who was part of the team. The new opportunity for credit, now part of the bank’s ₹51,000 crore wholesale trade (non-industrial) exposure, came about thanks to the visibility of cash flows in the current accounts of the traders concerned. Playing it by the ear in chasing credit is the reason why the bank’s book is pristine with a net NPA of 0.3% (gross NPA is 1.26%) on gross advances of ₹25.21 lakh crore as of December 2023.

Business opportunities apart, the bank is also looking to tap into localised hubs to feed its liability machine. Here again the road trips have helped. Recently, on a tour to Uttar Pradesh, the CEO got to pass through a cluster of villas in Bareilly, counted among the largest metropolises in western U.P. Not wanting to miss out on the growth opportunity playing out in mofussil cities and towns, a small outpost of the bank soon came up in the vicinity of the 150-villa complex.

These visits are now an integral part of Jagdishan’s approach to leadership intertwined with a deep, personal engagement with employees across tiers. In doing so, the larger agenda, too, gets fulfilled — getting to know the pulse of the economy through the bank’s sprawling 8,091-branch network.

While the road trips tend to glide smoothly, Jagdishan’s three-year sojourn at the helm has been a tumultuous one. He took over when the pandemic was raging, had to endure the rap of the central bank for its digital glitches and is now mandated with the arduous task of sweating out the merger with HDFC for synergistic benefits. All this even as the narrative on the Street is turning morose with the stock trading close to its 20-year price-to-book low, given that the bank’s impeccable liability and return metrics took a knock after the merger took effect in July 2023. Though the market cap has come off 16% since the year began, the bank still ranks among the top global banks. (See: Making the big league).

More Stories from this Issue

When David Becomes Goliath

Like the saying goes, history doesn’t repeat but rhymes. Just as ICICI Ltd. had amalgamated with its banking arm, ICICI Bank, in October 2001, parent HDFC got subsumed into the bank, in one of the biggest mergers in India’s financial history. The big difference is that the merger has not just widened its lead over ICICI Bank, the third-largest bank now, but also got HDFC Bank closer to State Bank of India, the country’s largest lender. HDFC Bank’s advances (₹25.21 lakh crore) are double that of ICICI Bank’s ₹12.29 lakh crore (See: How they stack up) but still below SBI’s ₹35.98 lakh crore. As the country’s second-largest lender, HDFC Bank accounts for 10.78% of overall deposits and 15.80% of net advances.

But the heft has come at a heavy price.

For 28 years, the bank enjoyed a certainty of execution and robust margin and return metrics, which the Street was used to. But following the merger, the net interest margin (NIM) has wilted from a peak of 4.6% to 3.4% (Q3FY24), given that home loans are a low-yield product. Post merger, while the yield on assets bumped up from 7.9% (March 2023), to 8.3% (December 2023), net interest margins from interest-earning assets shrank from 4.1% to 3.4% as the low-yield mortgage loans got transferred. HDFC Bank’s loan to deposit ratio (LDR) increased to 110% against its pre-merger LDR of 85%. In short, it lent out more loans than what its deposits could fund. For instance, as of December 2023, advances stood at ₹25.21 lakh crore, outpacing deposits of ₹22.12 lakh crore. This means the bank had to borrow high-cost funds to grow its books.

(INR CR)

Further, its funding mix has got severely dented by the inheritance of ₹5 lakh crore long-term, non-redeemable bonds from the parent, resulting in the composition of high-cost bonds increasing in the liability mix from around 7% to 21%. For every ₹1 lakh crore of these bonds, the bank’s NIM dips 12 basis points.

“What we have inherited is something that we have to accept. We realise that effectively we have preponed the loan growth. So, I need that period of transition to warm up the engine to raise granular sustainable funding to substitute some of the bond maturities,” Jagdishan told Rahul Jain, head of research and banking analyst, Goldman Sachs, at a recent investor meet.

As bonds mature, the bank either has the choice to replace them with similar instruments or explore other cost-effective funding options. Deposits are less costly compared to bonds, but they carry a risk of early withdrawal, whereas bonds offer stability as they can’t be abruptly withdrawn. The management’s plan is to gradually implement these changes, ensuring sustained profitability and growth. As bonds mature, they will get replaced with lower-cost funds, which will eventually boost margins. The management anticipates that within the next 18 to 20 months, NIMs will recover from 3.4% to 3.67%, and gradually reach 4% in four years.

But for now, analysts are far from optimistic.

Goldman Sachs has cut the bank’s estimated FY25 margin assumptions by 10 bps even though it believes that it’s a systemic challenge which is not just confined to HDFC Bank. “We believe private banks and NBFCs could see challenges in the near-to-medium term if liquidity remains tight and they choose to pursue market share gains in lending at the expense of profitability,” mentions Jain in his Q3FY24 update on the bank.

While the bank achieved a return on assets of 2% in Q3, much of it came on the back of tax write-backs. Overall advances growth was 4.9% quarter-on-quarter, driven by commercial banking growth (7.3%) and retail growth (1.6%). However, since deposit growth has lagged loan growth, the bank’s loan-to-deposit ratio touched 110%, and since it had used excess liquidity to fund the loan growth, the liquidity coverage ratio fell to 110% from 120% in Q2. Even as analysts have turned sceptical, Jagdishan is steadfast in his belief that the bank will leverage the merger to double its balance sheet every four to five years.

Devina Mehra, founder and CMD of First Global, among the very first brokerages to put out a buy call at ₹38 in June 1996, mentions that though banking is not an easy business to be in, the bank has done way better than its peers. In fact, HDFC Bank is the only company in India to have the unique distinction of delivering growth in profit every year over the past two decades (See: The profit machine). “It’s been one of the most predictable earners. Now I cannot say that in 1996, I saw this. What happens in a big call, is at best you can say the stock will double or triple. But back then, even Aditya Puri wouldn’t have known the trajectory that lay ahead,” says Mehra.

While the past is beautiful, the current sentiment around the bank has more to do with expectations. The market wants to see rip-roaring growth from the merged entity whose NIMs have come down since mortgages have lower spreads and CASA, the fountainhead of cheap money for banks, has taken a knock. As of December 2023, CASA deposits grew 9.5% with savings account deposits at ₹5.79 lakh crore and current account deposits at ₹2.56 lakh crore, of the total deposits of ₹22.12 lakh crore. Time deposits were at ₹13.78 lakh crore, an increase of 42.1% against a year-ago, resulting in CASA deposits comprising 38% of total deposits. Now analysts want to see this ratio back to the pre-merger peak of 42% (See: Show me the deposits).

As against the initial plan of adding 1,500 branches in FY24, the bank has managed to add only 264 branches in the nine months. The expansion is crucial. Piran Engineer, analyst, CLSA India, mentions it would be nearly impossible for the bank to maintain 15-17% loan growth and expand margins as the ask rate (₹4.5-5 lakh crore annually) on deposit accretion — to deliver 15-17% loan growth — is quite high.

Managing Heft

If Jagdishan isn’t letting the M&A blues get the better of him it is also because he has the bank’s powerhouse of senior management team doing what is needed. The entire mortgage business (sans the developer book) is now being run by Arvind Kapil, another HDFC Bank veteran who has spent over 25 years at the bank running its retail business. While the bank has added around 10 million new customers in the nine months of the current financial year, taking the overall base to 93 million (See: Rolling the red carpet), Kapil is looking for a big kicker from the merger.

To begin with, the initial focus was not only on the integration of processes and teams, but also on understanding and adapting to the diverse market dynamics that the merger brought forth. “I was very clear that we will keep HDFC service centres just the way they are. We kept everybody sitting where they were sitting and doing predominantly the job they were doing. They just had to bifurcate credit and business functions,” reveals Kapil.

The bank’s agility in processing retail loans, particularly those with smaller ticket sizes, became a critical factor in navigating the competitive landscape. The process optimisation efforts, aimed at reducing turnaround times (TATs) for loan processing, were a cornerstone of the bank’s strategy. Kapil points out the vast differences in operational processes between the merging entities and how harmonising those was a monumental task. “Home loan proposals of the salaried class were taking seven-eight days, while the self-employed segment wasn’t a very high number for HDFC. Their TATs had a frequency distribution of 14-20 days. The process worked for them at the growth rates they wanted. But as a bank we have survived on small loans. My retail house used to be always running like an escalator as we had to be fast. We have managed to reduce the processing time to just two-three days,” he adds.

HDFC Bank’s proficiency in generating traction involving an approach of a rigorous sales process occurring twice a month, along with bi-weekly and bi-monthly evaluations, is what was brought about into the operations. The restructuring focused on streamlining credit processes and optimising resource allocation via advanced analytics and automation tools reduced processing times.

More importantly, the blending of different work cultures was essential in creating a unified, efficient, and goal-oriented team. “HDFC had impeccable relations with builders. But a lot of them were skewed at the top. It was not institutionalised all-across that I could ask a guy who knew everything on a national level, though at a granular, micro-market level, their expertise was close to brilliant. So, we had some of these as challenges because in the bank we had institutionalised processes,” mentions Kapil.

While the bank has been focused on the salaried class, its exposure to the self-employed segment through working capital is now helping it build the mortgages business. Unlike HDFC, which was less at ease with the self-employed, the bank wants to ramp up this exposure. By doling out working capital loans and business loans, it has established a strong underwriting culture and skill set. Coupled with the advent of credit bureaus and the GST regime, the ability to analyse the credit worthiness of the self-employed has increased in recent times. “I see that as a very substantial growth engine (for home loans) for the bank,” says Kapil. Already the bank’s market share has grown approximately by 18% to 20% on incremental home loan disbursals.

But the big incentive for the bank is the ability to leverage customer relationships with the parent. Only 35% of HDFC’s customers had a HDFC Bank account. That composition is changing, with over 80% of incremental business now becoming a HDFC Bank customer. Having a customer route his/her EMI through a savings account results in a significant increase in CASA. Usually, a customer tends to keep six to nine months of EMI balance in the account, which can extend to even a year. This not only boosts the bank’s CASA proportion significantly but also strengthens the digital connection with the customer. Besides, the bank has identified nine products for sale, of which almost 70% look pretty much a reality in the first year. So, the customer’s journey with a mortgage becomes a fully digital banking journey. “This is the reason my visiting card mentions mortgage banking as we want to own the whole relationship from liabilities to incremental assets,” says Kapil with a smile.

Living With Uncertainty

In the coming quarters though, the pertinent question that analysts will continue to ask of the management is whether the bank can bolster NIMs through yield on loans, given that its cost of funds is unlikely to see a sharp fall. Over the Q3 earnings call, CFO Srinivasan Vaidyanathan kept telling analysts that the bank will not be slugging it out with competition either to grab deposits or push credit. “In recent times, we haven’t had that kind of market growth in the unsecured segment. Personal loans have been growing 2-3% over the past two quarters. So, we do have an opportunity there. But that will be driven by our credit process, which periodically gets calibrated up and down,” said Vaidyanathan. Post merger, approximately 70% of customers were new to the bank. Notably, 40% of them have already opened savings accounts. The onboarding of new customers highlights that the bank is milching the integration well. Besides, the bank is looking to tap into its existing customer base to leverage its mortgage business. “We have almost 4.8 million pre-approved, pre-qualified database comprising eligible customers and we are making offers,” says Vaidyanathan.

The management is very clear about one rule — it won’t sacrifice profits at the altar of growth. “We certainly do not want growth for the sake of growth. In Q3, our wholesale growth was just 1.9%. Enough demand was there. Several banks were engaged in undercutting (rates)…But we don’t need to participate if it does not give returns. Neither do we tell customers to come open an account with us for the best deposit rates,” clarifies the CFO.

Jagdishan, too, articulated a similar view on liabilities at the Goldman Sachs investor meet. “Wrong or right, we took a call not to participate in some of the high-cost incremental flows. Not only did we not participate, but also had to give up some (deposits) which came up for maturities. Even if it continues for a couple of quarters, we are sanguine about it as we feel that our earnings trajectory should not be impacted,” Jagdishan told Jain.

That ability to say no to what the Street would like to see versus what’s right for the bank is in some sense the secret sauce of the bank’s compounding prowess. Just savour this: the bank has compounded returns at 23.39% since 1995 till date, double that of Sensex’s 11.72%.

However, Rushabh Sheth, co-founder and co-CIO of Karma Capital, which manages over ₹5,000 crore through a PMS, believes past performance is no guarantee of the future. “I think the business is hitting a glass ceiling. You cannot grow bigger because you have a certain percentage of the market. We owned SBI for five years. The bank’s market share is only 20% (of advances). They haven’t lost market share, but neither have they gained. HDFC Bank, too, will reach a point where it will be like SBI. You can’t gain market share anymore as you are the market!” says Seth.

Interestingly, though the consensus on HDFC Bank for the near term is far from inspiring, Vinod Karki, analyst at ICICI Securities, believes the bank will emerge as India’s first trillion-dollar m-cap stock by 2032 driven by peak PAT/GDP ratio. “HDFC Bank’s hurdle rate of around 25.5% against its historical profit growth trajectory of around 20% makes the stock a prime contender with scope for valuation re-rating,” mentions Karki.

Whether the bank will be able to keep up with its historical growth rates is anybody’s guess, but Jagdishan is confident and recently told a clutch of investors: “Even if I step down tomorrow, the bank will continue to grow. That’s the beauty about this engine. We are here to ensure that investments in technology, in people and culture are invested appropriately so the growth coming tomorrow will be enduring over the next 5-10 years.”

Yet, a performance-oriented Street will want the bank to prove — every quarter — that the merger is delivering the goods. Any hiccups on that front will not be viewed favourably. Given its substantial weightage — 26.41% in Bank Nifty and 6.75% in the Nifty — any broad-based selling could also significantly dent sentiment. Of the total institutional ownership of 83.10%, FPIs own 52.13% in the bank and despite concerns, the number of foreign investors has increased from 3,814 to 3,844 in the December quarter. “The stock might be a great tactical play but not more than that. My problem is that it (the bank) does not fit into our criteria of owning businesses which have the potential to create a much larger market expansion,” says Sheth. Engineer of CLSA points out that foreign investors are not as bearish as their domestic counterparts as they believe the “EPS cuts” cycle is bottoming out. For instance, Rory Dickson, fund manager of the U.K.-based $23 million Chikara Asian Evolution Fund, has loaded up on the stock which now accounts for 4.8% of the fund’s AUM. “One pocket of value and quality that has emerged is HDFC Bank. With the lowest valuation in 20 years for a three-year forecast profit CAGR of 17% and 17% RoE, we see this is an opportunity that we cannot pass up, and added to our position,” states Dickson in a recent fund update. Back home, Life Insurance Corp. (LIC) has also received approval from the RBI to increase its stake to 9.99% from 5.19% within a year (by January 2025).

Last year, the banking sector was on a roll with the NPA cycle bottoming out amid robust credit growth. As interest rates rose, initially, NIMs increased. But that play is over. As a result, Mehra of First Global sounds circumspect. “There is nothing wrong with HDFC Bank, but when you are that big, there must be something more to drive your growth. And, as of now, our systems have not signalled that banking is looking very good. We will still have some position in HDFC Bank and other private banks, but that’s a definite underweight sector for us,” says Mehra.

While the Street is fixated over the narrative — the bank is at peak margins, it can’t get better than this. It has the lowest credit cost, it can’t go lower than this — one cannot ignore HDFC Bank’s substantial holdings in key subsidiaries engaged in financial services distribution, life insurance, asset management, general insurance, and the securities business. Besides, the lender, whose profits have grown annually at average 28% since inception, has kept the momentum going with its PAT surging 39% in the nine months of FY24. That speaks volumes about the quality of the franchise. Though analysts are slashing the valuation premium, their 12-month target prices are 32-47% higher from current level of ₹1,438. But the irony is that HDFC Bank, which no longer has an identifiable promoter, will be far more vulnerable to a fair-weather Mr Market because of its high weightage. So, even if the Street does not let the drums roll for the bank, a crisis-hardened Jagdishan will make it a point to not miss the bus.