RBI's MPC keeps repo rate, inflation forecast unchanged; FY25 GDP pegged at 7%

RBI keeps the key policy rate unchanged at 6.5% for the sixth time in a row; to remain focussed on MPC ‘withdrawal of accommodation’

In line with expectations, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC), in its bi-monthly policy announcements today, kept the repo rate unchanged at 6.5% for the sixth time in a row.

The RBI-led MPC has also decided to keep the marginal standing facility and bank rates unchanged at 6.75%, while the standing deposit facility remains at 6.25%.

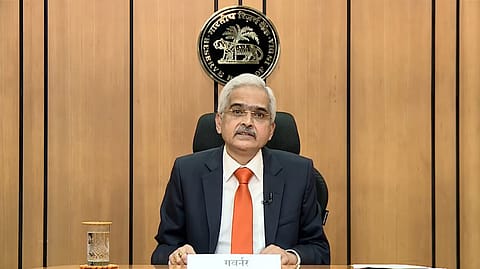

The RBI governor says the MPC remains focussed on its stance of the "withdrawal Of accommodation", and five out of six members have voted its favour.

"The RBI stands for trust, stability and economic progress... odds of soft landing have increased globally as the global economy continues to present a mixed picture," says RBI governor Shaktikanta Das.

On the global outlook, the RBI governor says the ongoing wars and emerging crises in the Red Sea crisis have posed "uncertainty" on the global outlook.

The RBI governor says the world will see "steady" growth in the year 2024, though the trade momentum remains "weak" globally.

In line with this, the RBI has announced the economic GDP growth estimates for FY25 to 7%. For Q1 FY25, the RBI's GDP growth projection stands at 7.2%. The economic growth projections in Q2 are at 6.8%, Q3 at 7% and Q4 at 6.9%.

Recommended Stories

The central bank, in its last meeting in December 2023, had decided to increase the GDP estimate for the full fiscal year FY24 to 7% from 6.5% earlier.

On the inflation front this time, the RBI says the MPC has decided to keep the inflation estimate "unchanged" for FY24 at 5.4%, although the food price shocks and disruptions in the global supply chain could cause inflation to rise.

The retail inflation data released last month had showed the consumer price index (CPI)-based inflation rising to a 4-month high of 5.69% on an increase in food price inflation. Inflation in all the other components increased at a lower rate when compared to the previous month. The pick-up in inflation was driven by an unfavourable base effect of around 10 bps.

In the latest RBI's regulatory announcements, Das has directed all the banks to issue a "key fact statement" on all retail and MSME loans. In this statement, they will have to mention processing fees and any other charges.

(INR CR)

On the situation of current account deficit (CAD ) for FY24 and FY25, Das says India's forex reserves are comfortable ($622.5 billion) and that the country's CAD remains manageable. India's current account deficit had narrowed to 1% of the gross domestic product (GDP) at $8.3 billion in the July to September quarter of FY24, as against $9.2 billion in the previous quarter, the RBI data shows.