Anchor in choppy waters

ADVERTISEMENT

WITH MARKETS HIGHLY volatile and interest rates fluctuating, fixed maturity plans (FMPs) are gaining popularity. In all, 742 FMPs were launched between March 2010 and Feb. 21, 2011, compared with 368 between April 2009 and March 2010. FMPs are mutual funds that invest in debt and money market instruments, and government securities. Investment in an FMP is for a stipulated time and has a lock-in period decided at the time of the initial offer. They are closed-ended schemes with maturity periods ranging from three months to three years.

“Last year, equities didn’t do much. In general, there’s been a marked increase in investor preference for fixed income,” said Suresh Soni, managing director and CEO of Deutsche Asset Management, India, which launched 13 FMPs between April 2010 and February 2011. In 2009-10, it had made five such offers.

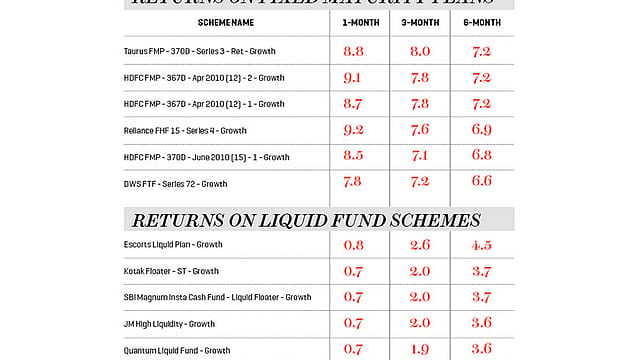

“Four months ago, the yield on one-year corporate debt was at 7.9%. Now it’s 9.6%. Investors in FMPs four months ago might have thought they were locking in at high rates, but yields have moved up higher, as the RBI looks to tame inflation,” says Harshendu Bindal, president, Franklin Templeton Investments, India. In the last six months, the best FMPs have outperformed top liquid funds (see table) , which invest in similar securities.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

One of the reasons why FMPs are back in favour is that the Securities and Exchange Board of India (Sebi) now keeps them on a tight leash. Four years ago, many such funds had put investor money in risky assets such as real estate company fixed deposits and non-banking finance company investments. The borrower firms defaulted on repayments because of the recession. Sebi then put in place strict norms for new fund offers. “In 2006-07, FMPs were a new product and regulations were also evolving. Then their growth was affected by regulatory changes. Now they are understood better and the regulations are much clearer,” says D.R. Dogra, managing director and chief executive officer, Credit Analysis & Research, a rating agency.

The other factor drawing investors to FMPs is tax benefits. Under the dividend option, earnings attract only a dividend distribution tax. In the growth option, returns are subject to capital gains tax, but investors can go for indexation, a mechanism to factor in inflation to calculate returns, which are taxed only if they cross the average rate of inflation in the fund’s tenure.