Base instincts

ADVERTISEMENT

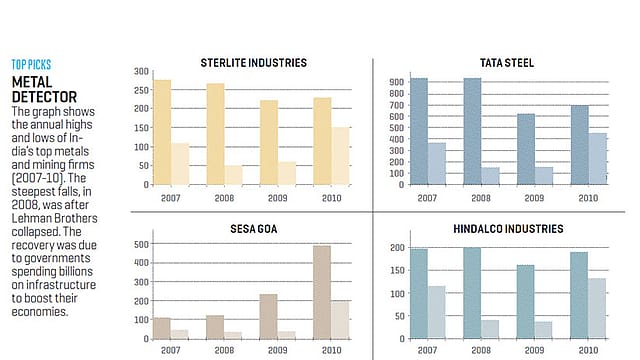

SEPTEMBER HAS SEEN the steepest rise in the Sensex in three months, and it is close to the 20000 mark. With equities on fire, should an investor bother to look at other asset classes, such as commodities? “Definitely,” says Devesh Kumar, joint managing director, Fortune Financial Services, India. According to him, there’s increased foreign institutional investor interest in the market. “That’s why many blue-chip stocks may be overvalued,’’ he adds.

One sector unaffected by the optimism is commodities. Almost all stocks in this sector are way below their 52-week highs. Prices have crashed amid global fears that China may be taking steps to cool its economy and Europe could take longer than anticipated to recover from the recession. “The other big fear is that many sector-specific stimulus packages may be rolled back, resulting in a dismal October to December quarter,” says Navin Vohra, partner, Ernst & Young, a leading consultancy.

Commodity prices hinge on demand and supply. “There is likely to be a global shortfall of 50,000-100,000 tonnes of copper this year,” says Praveen Singh, senior commodity analyst at Sharekhan Research. Low prices have prompted many mines to delay new projects, while smaller ones have shut down. A supply shortfall is likely in other metals, too. A March 2010 report by British commodities consultants VM Group and Fortis Bank Nederland forecasts a 500,000-tonne shortage of zinc by 2014. At the same time, demand is rising. In India, the Prime Minister’s Advisory Council expects industry to grow by 9.7% in 2010-11. Auto makers, among the biggest consumers of steel, have announced capacity expansion plans. Tata Motors has earmarked Rs 2,500-3,000 crore to expand its India plants this fiscal. Maruti Suzuki plans to increase output at its Manesar plant near Delhi.

January 2026

Netflix, which has been in India for a decade, has successfully struck a balance between high-class premium content and pricing that attracts a range of customers. Find out how the U.S. streaming giant evolved in India, plus an exclusive interview with CEO Ted Sarandos. Also read about the Best Investments for 2026, and how rising growth and easing inflation will come in handy for finance minister Nirmala Sitharaman as she prepares Budget 2026.

The shortfall will hit other industries, too. And metal companies will see huge profits. Analysts say the demand for steel will rise 12% by 2011. The fortunes of Sesa Goa, the top iron ore producer, should improve. Its stock price is currently Rs 325.25 (Sept. 17, 2010), 33.72% below its 52-week high. For other players, the tide is already turning. The stock price of Hindalco, a leading low-cost aluminium producer, is at a six-month high. Other mining firms will also profit.

Financial planners recommend that commodity stocks form at least 5% of any portfolio, as they’re a hedge against inflation.